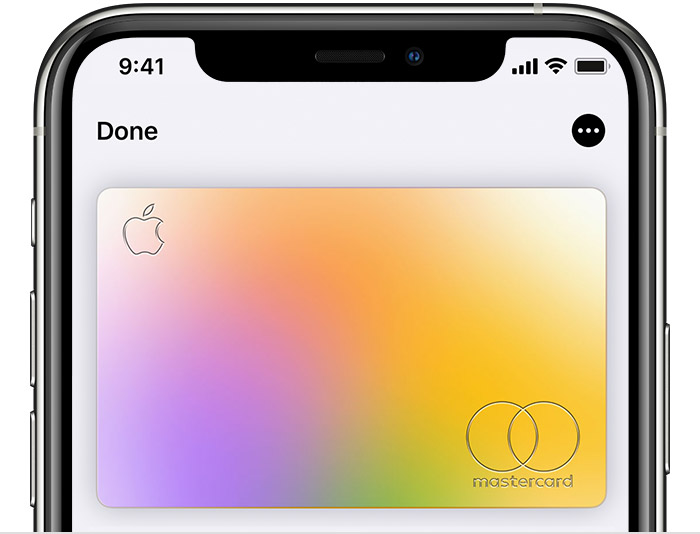

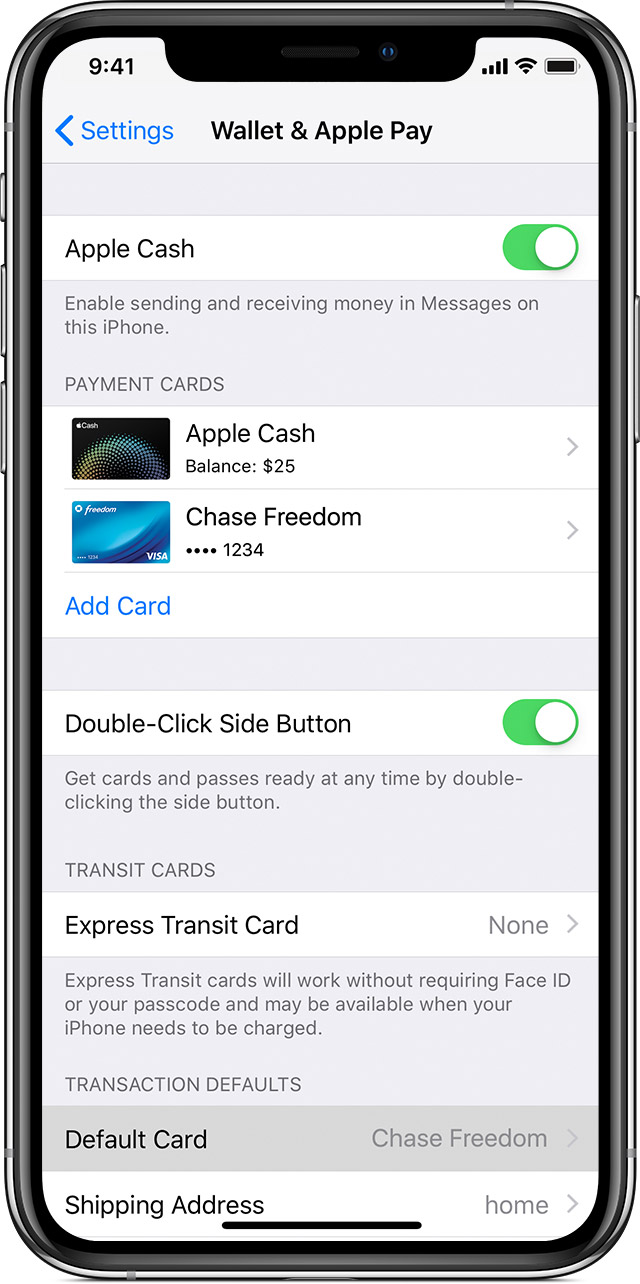

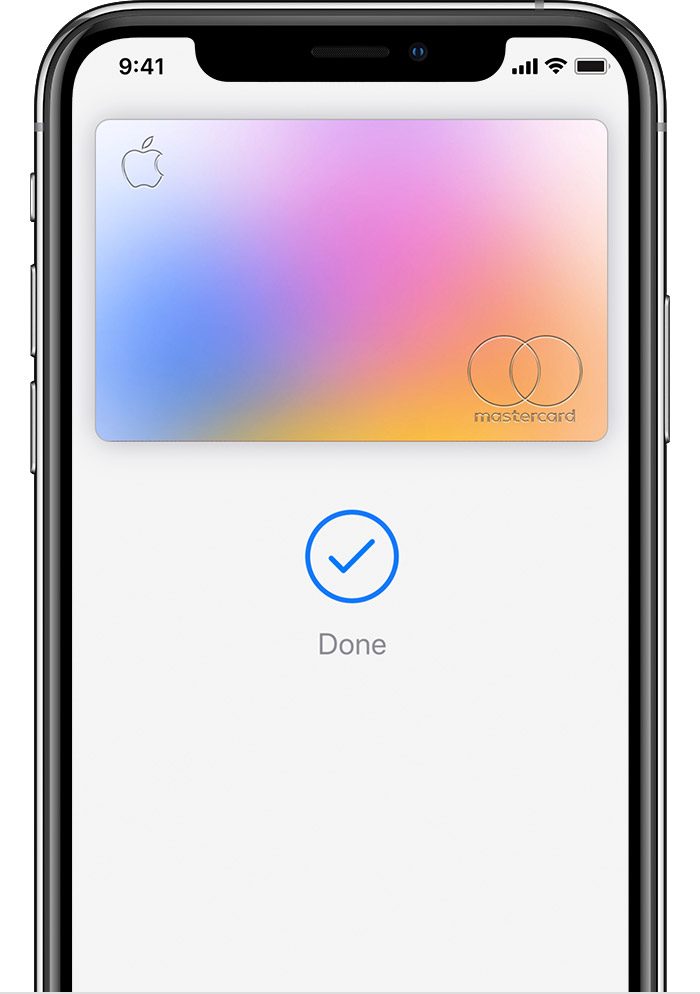

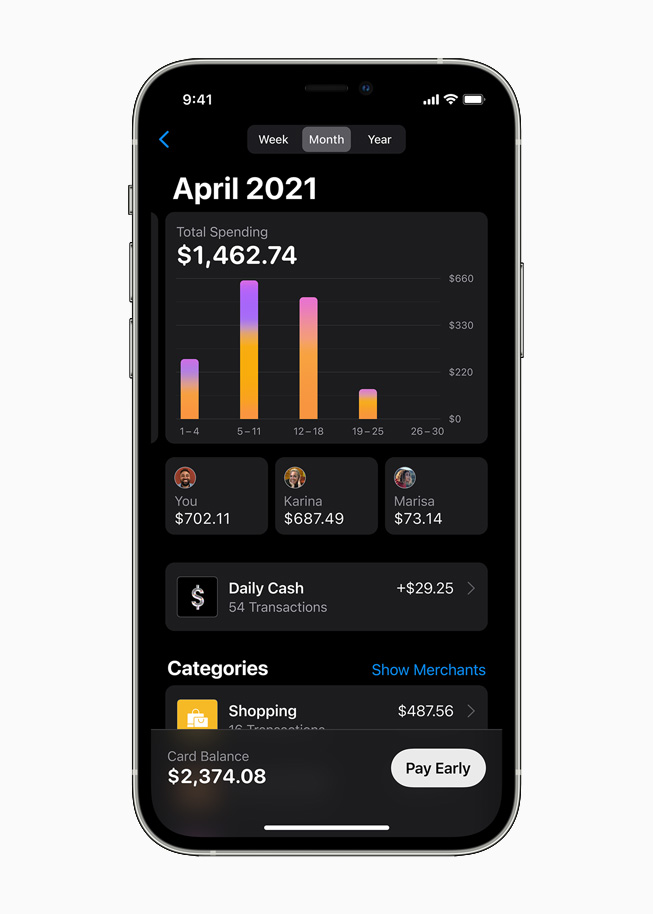

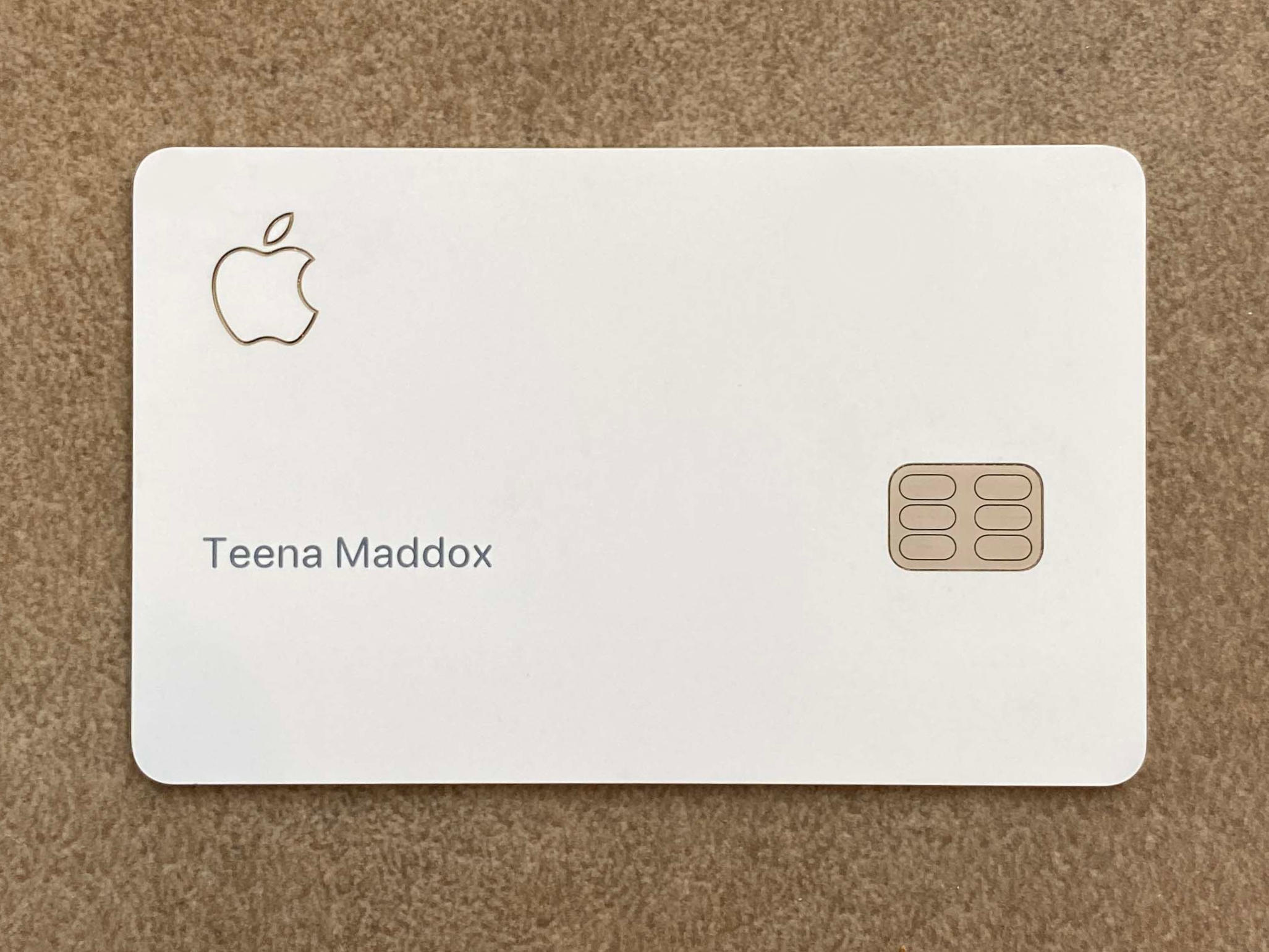

· Apple Card is built straight into the Wallet app found on iOS devices, and links directly to Apple Pay Apple partnered with Goldman Sachs to manage the financial side of the card Apple Card was built specifically for use in Apple Pay, but still functions as a traditional, noncontactless credit card when necessary · Last month, Apple announced several notable updates to the Apple Card, including an option to easily add authorized users to your account Best yet, you can share your credit history with individuals you choose to add, so they can build credit without having an account of their own · The Apple Card is the first credit card offered by Apple, and issued by Goldman Sachs It's designed to work with the iPhone's Wallet app and Apple Pay For

Apple Card A Surprisingly Great Card But Who Needs It By Michael Beausoleil The Startup Medium

How to apple card

How to apple card-Every potential issue may involve several factors not detailed in the conversations captured in an electronic forum and Apple can therefore provide no · Apple Card review Now, Apple's adding some features that go beyond improved cashback rewards As the company detailed on Tuesday, the new Apple Card Family will make it easy for users to share one account with up to five other people that are 13 years or older

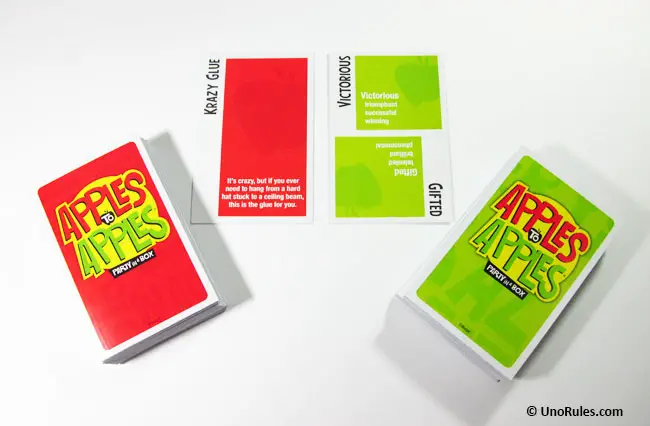

Dirty Apple To Apples Cards Against Humanity Cardsagainsthumanity

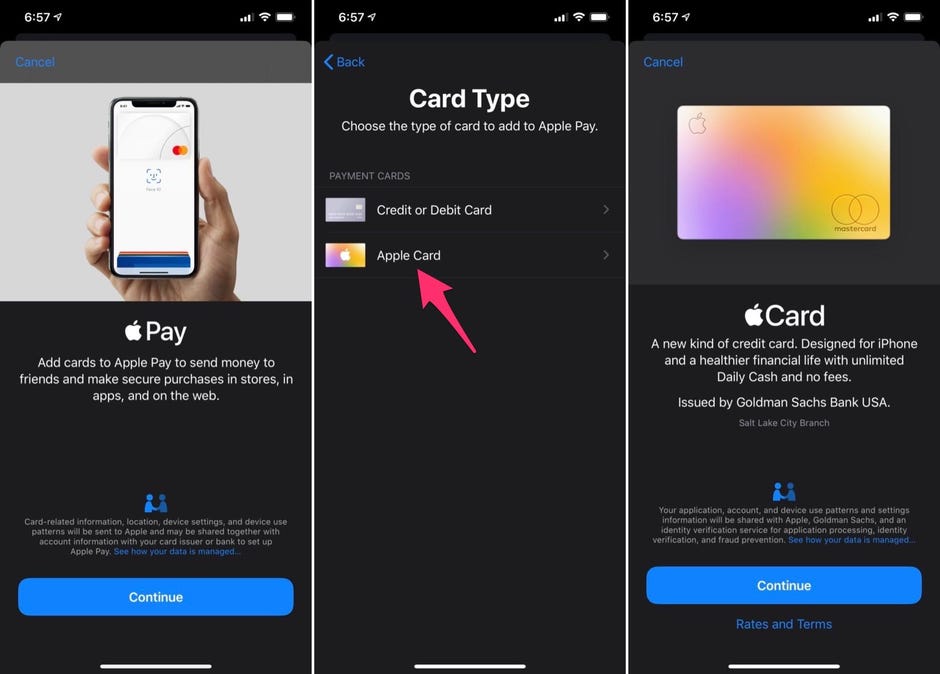

Apple Card is a credit card created by Apple Inc and issued by Goldman Sachs, designed primarily to be used with Apple Pay on Apple devices such as an iPhone, iPad, Apple Watch, or Mac Currently, it is only available in the United States History On August 6, 19, invitations to an early preview started · Apple used its Spring Forward event last month to announce the Apple Card Family which allows for coownership and family sharing of the company's credit card · The Apple Card is Apple's first entry into the credit card market It was created in partnership with Goldman Sachs and is a Mastercard, meaning it's accepted wherever a

The USBC to SD Card Reader transfers highresolution photos and videos at UHSII speeds to your Mac or iPad Pro Buy now at applecom · Apple did make some gains among Baby Boomers, however At the beginning of , Boomers accounted for just 3% of Apple Card holders—by the end of the year that percentage had more than doubled · The 2% cash back on most purchases matches many of the highest flatrate cashback cards on the market But it comes with a big asterisk, because you must use Apple Pay to get elevated rates The

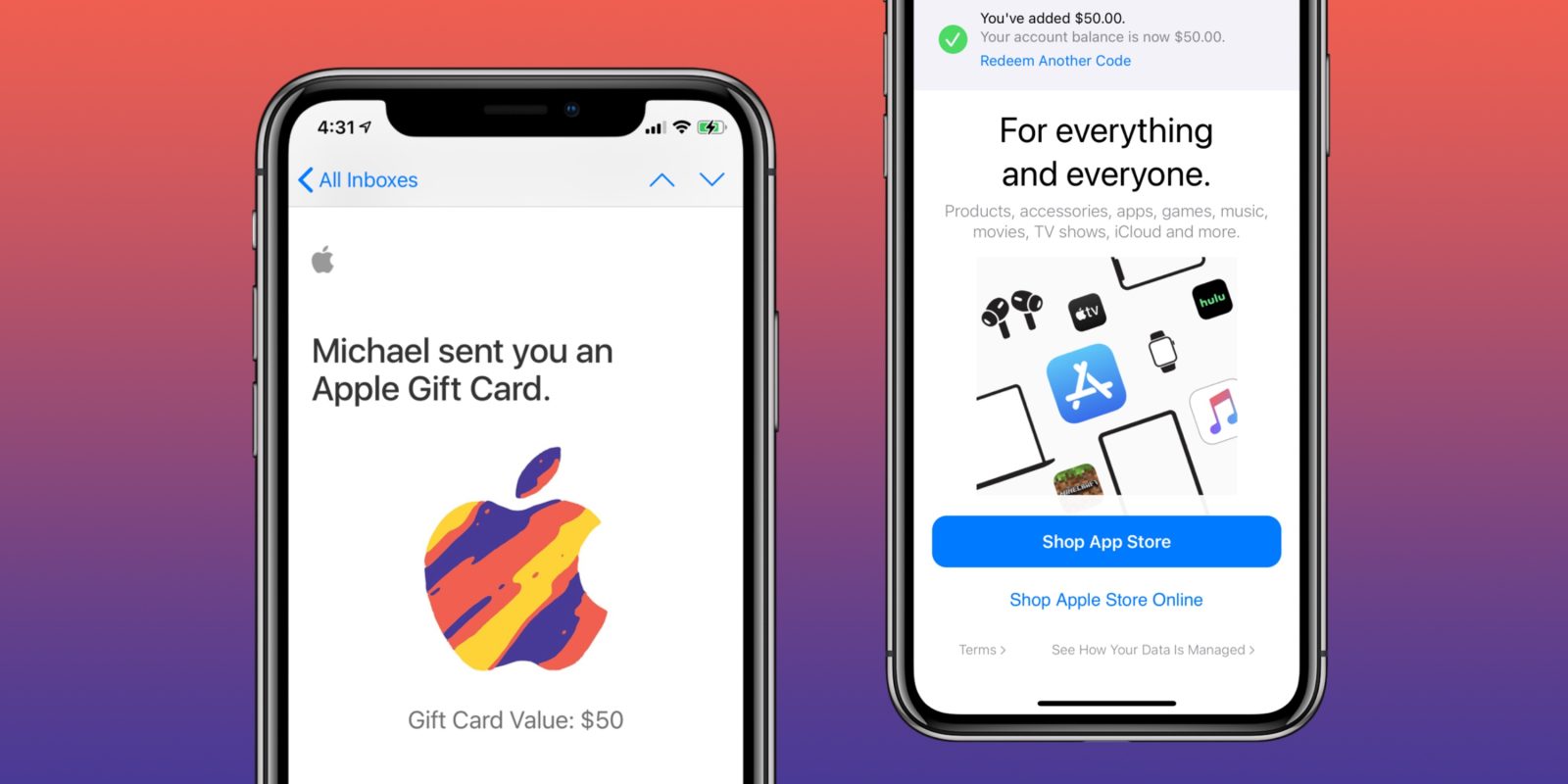

17 results for "apple gift card" App Store & iTunes Gift Card Delivered via Email 47 out of 5 stars 3,700 £1500 · In August of 19, Apple launched the Apple Card across the US The credit card works with the Apple Wallet app to streamline payments for Apple customers Cardholders who want the actual card can/04/21 · (Pocketlint) Apple's credit card, the Apple Card, is nearly two years old Apple teamed up with Goldman Sachs and MasterCard in 19 to launch the Apple Card

Apple Card A Surprisingly Great Card But Who Needs It By Michael Beausoleil The Startup Medium

Apple Card Apple

· When the Apple Card debuted in August 19, Apple noted that it would have a variable APR of 1299% to 2399% based on creditworthiness The low end of that range is better than average — and · The source said the Australian launch of Apple Card is likely to take place at the same time as either iOS 141 or 142 later in the autumn, following the expected rollout of iOS 140 in/04/21 · Apple Card also offers Daily Cash®, which gives up to 3 percent of every purchase as cash on users' Apple Cash card each day 2 And with no credit card

Pin On Board Games

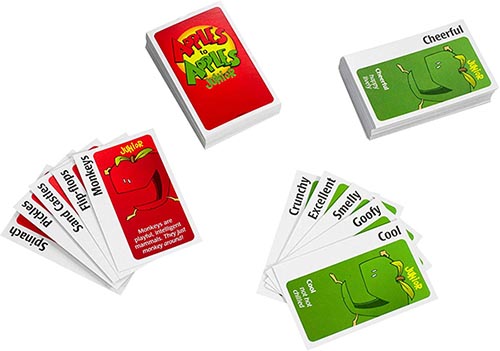

Apples To Apples Junior The Game Of Crazy Comparisons Amazon Sg Toys Games

· What is the Apple Card?CoOwnership means you can share an Apple Card account with your spouse or partner and build credit equally Learn more and apply now http//appleco/AppleC/04/21 · The first new announcement during Apple's "Spring Loaded" event was an update to Apple Card, adding the previouslyrumored multiuser support Launching in the US in May, Apple Card Family will

Apple S Pay Services Explained And How To Find And Change Payment Methods

Apples Against Humanity Program Idea I Had Combined Both Card Games Cards Against Humanity And Apples To Apple Program Ideas Creative Advertising Card Games

· Apple Footer This site contains user submitted content, comments and opinions and is for informational purposes only Apple may provide or recommend responses as a possible solution based on the information provided;1% cashback when using the physical card is absolutely dismal 2% back on apple pay is limiting and most cards offer between 15% and 2% cashback (ie citi doublecash) You'll get that flat cash back regardless of apple pay or not The 3% back on select stores is okay but honestly is beat by any revolving category cards · Apple also announced Apple Card — a "new kind of credit card" that has been "created by Apple, not a bank" In typical Apple fashion, the company is changing many aspects of how a credit card works with the Apple Card

/cdn.vox-cdn.com/uploads/chorus_image/image/67138387/Screen_Shot_2020_07_31_at_9.57.29_AM.0.png)

Apple S New Universal Gift Card Can Be Used To Purchase Everything Apple The Verge

Bescherelle Le Jeu And Other French Language Games

· The new program, Apple said, would allow multiple family members to have an Apple Card, with coowners able to build credit together In fact, Apple added that it · Apple's brand is the only one to feature on the minimalist styling of its card's face, and many of its consumers have higher expectations of its behaviour than they would do for other payment card · Apple today released iOS 146, with it bringing support for Apple Podcasts subscriptions and new support for Apple Card Family Announced last month, Apple Card Family allows families to

4 Party Game Series Apples To Apples

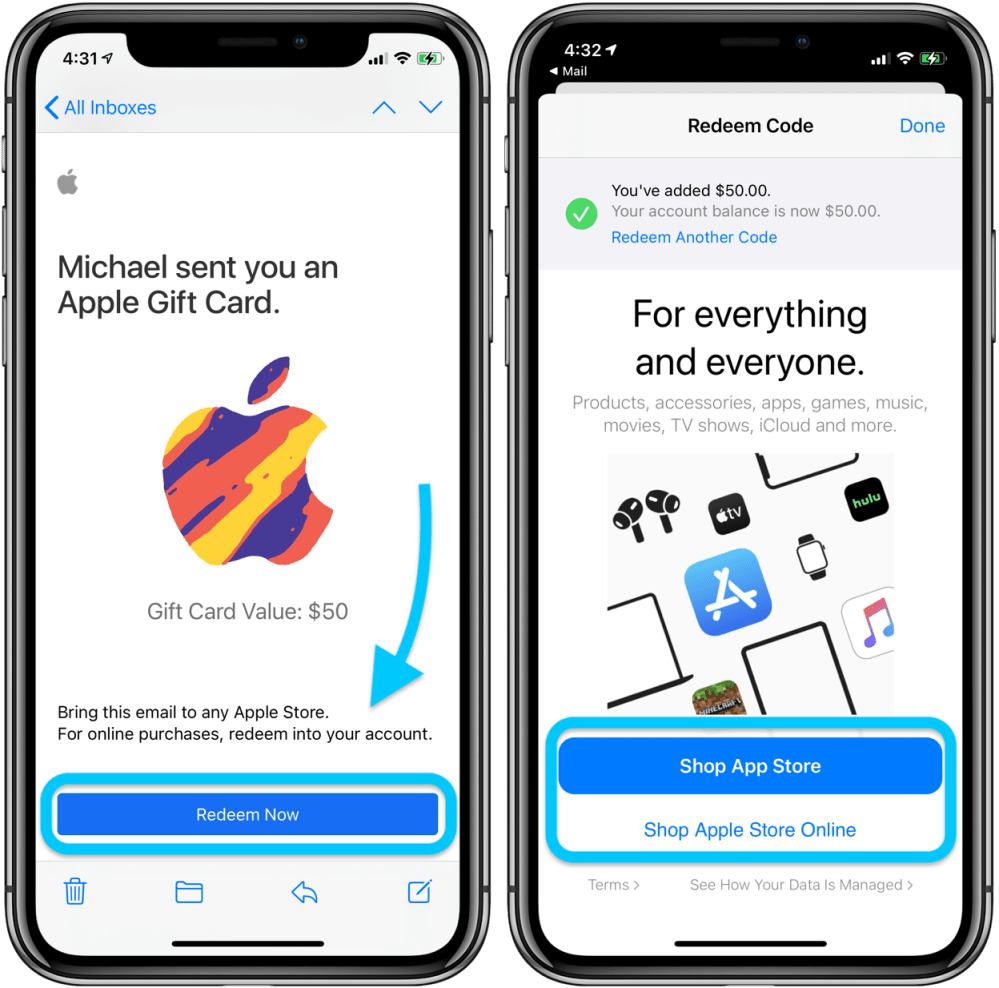

How To Use Apple Gift Card On Iphone Ipad Mac 9to5mac

2 days ago · The Apple Card provides the most benefits to those already locked into the Apple ecosystem For one, you need to have an iPhone to even be eligible for the Apple Card Two, there are lots of Apple Card features that you won't benefit from if you aren't a frequent Apple user An example of this is the recent addition of Apple Card Family19 hours ago · The Apple Card is designed to work digitally To start, you apply through the Apple Wallet app, though you can also apply online after logging in with your Apple ID · Following its announcement last month, Apple today officially flipped the switch to allow parents to share their Apple Card with their teenagers or friends and the ability for

How To Play Apples To Apples Junior Official Rules Ultraboardgames

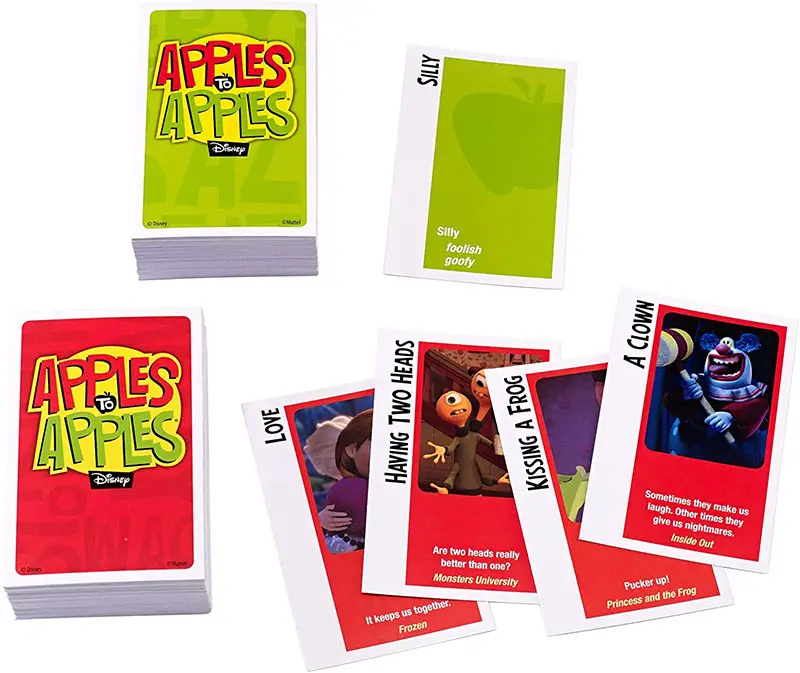

Mattel Disney Apples To Apples Game User Manual Manualzz

Powered by Goldman Sachs and MasterCard, the Apple Card is a oneofakind credit card from Apple that is linked to Apple Pay and built into the Apple Wallet app on iPhone · How Apple Card Family Will Work The idea of authorized users on credit cards isn't new, and neither is the ability to open a joint credit card · The short answer is no As we said, Apple Card is tied to Apple Pay and doesn't work without it Given Apple's record of building devices that are only compatible with one another, it's unlikely things will change in the future In a nutshell, don't hold your breath while you wait for Apple Card to become available on Android

How To Add A Bank Account To Your Apple Card Macrumors

How To Apply For Apple Card Apple Support

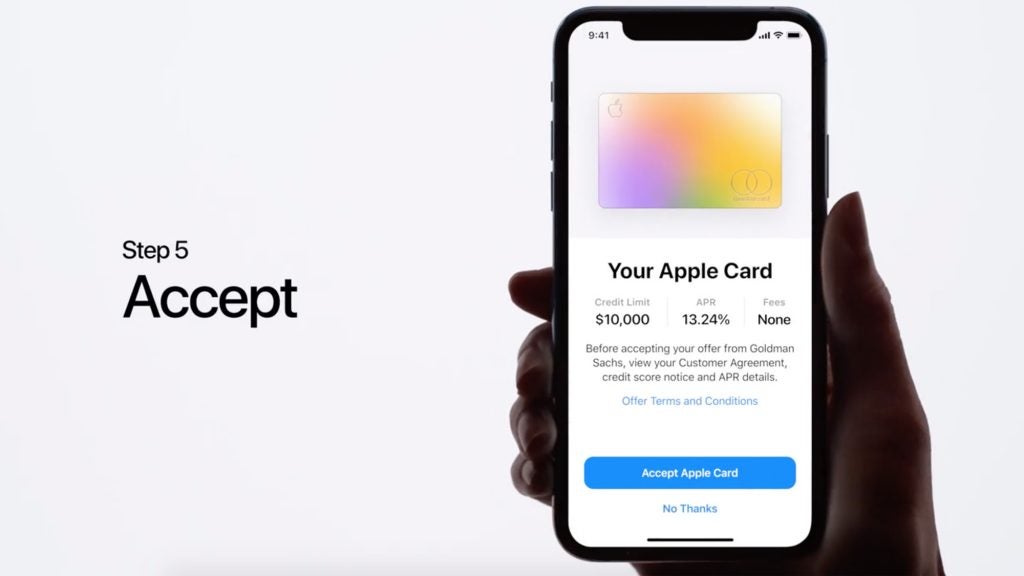

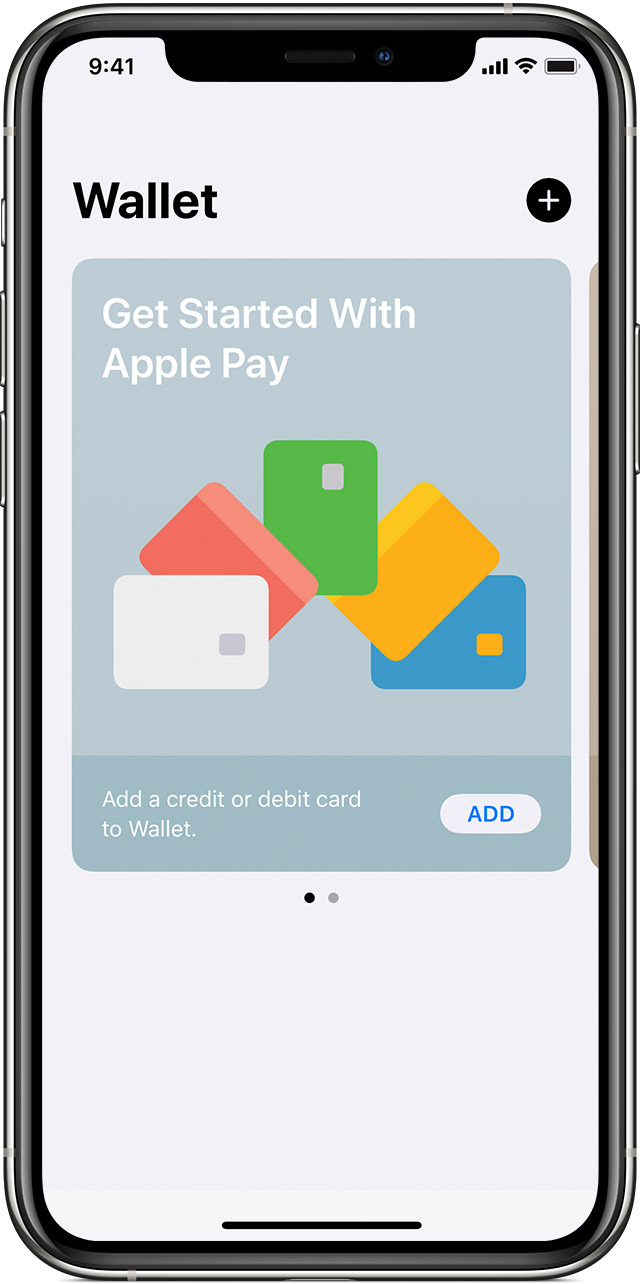

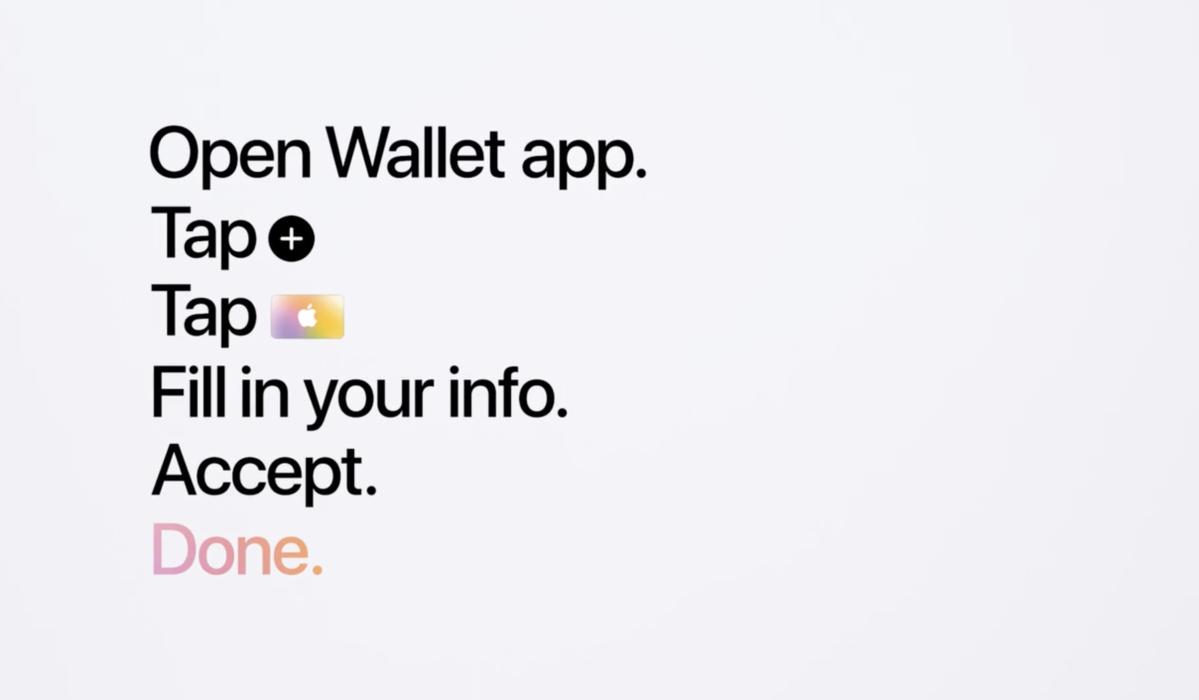

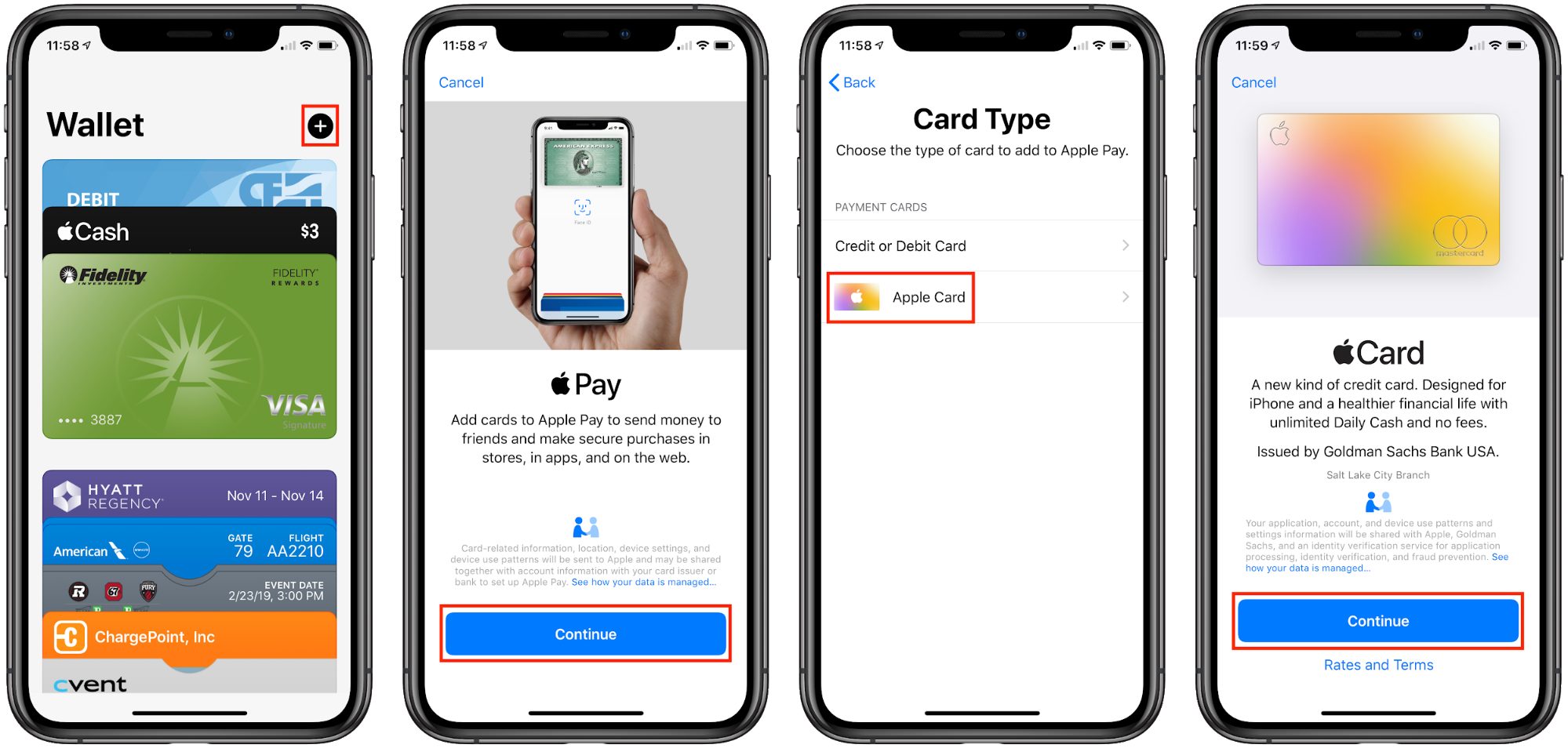

· Apple Card is issued by Goldman Sachs Bank USA, Salt Lake City Branch Each coowner is individually liable for all balances on the coowned Apple Card including amounts due on the existing coowner's account before the accounts are merged Each coowner will be reported to credit bureaus as an owner on the account · Apple Wallet, the default iPhone wallet app on iOS, allows you store credit cards, debit cards, passes, tickets and importantly, loyalty cardsPhysical loyalty cards can be difficult to keep track of, difficult to store and you might forget you even have one for a specific retailer · Open the Wallet app and tap the add button Select Apple Card, then tap Continue Complete your application Review and agree to the Apple Card Terms & Conditions Accept your offered credit limit and APR 3 After you accept your offer, Apple Card is added to the Wallet app and you can request a titanium Apple Card

Knights Of The Cardboard Castle Dixit Apples To Apples Knights Of The Cardboard Castle

How To Play Disney Apples To Apples Official Rules Ultraboardgames

· The card earns 3% cash back on anything you buy from Apple including devices, games in the App Store and services like Apple Music or Apple TV Select merchants like Walgreens, Exxon and Nike also help you get 3% cash back Users receive 2% back any time they use Apple Pay and pay with the Apple Card and 1% for all other purchases · Apple Card is a new credit card which comes in both a digital and sleek titanium form It is powered by the iPhone and has been designed to be integrate seamlessly with the Wallet app for iPhone · Head to the Wallet app on your iPhone and select Apple Card Tap the threedot icon in the top right corner Now choose Share My Card > Continue Pick who you'd like to share Apple Card

Apple Card Wikipedia

Apples To Apples Junior Game Review Printable Game Sheet

· The Apple Card lets you accrue Daily Cash that gets added to your Apple Cash account Find out why that matters and how you can ultimately redeem your rewardsApple Footer This site contains user submitted content, comments and opinions and is for informational purposes only Apple may provide or recommend responses as a possible solution based on the information provided;Every potential issue may involve several factors not detailed in the conversations captured in an electronic forum and Apple can therefore provide no guarantee

I Ve Used The Apple Credit Card For A Year Here S What I Think Now

Apples To Apples Who Plays It And What S It All About The Dis Disney Discussion Forums Disboards Com

Give them an Apple Store Gift Card and they can get Apple hardware and accessories at any Apple Store, at Applecom or by calling 0800 048 0408 Choose from a variety of designs and denominations to make it just the right gift Apple Store Gift Cards by Email Email a gift card with a personal message · Apple Card is basically designed to live inside your iPhone in your Wallet App Made of titanium, you can use the physical credit card by swiping, similar to other credit cards or you can use online or wherever Apple Pay is accepted via your iPhone Yet again stepping outside the box, Apple does not feature the usual card number on its AppleBecause Apple Card is part of the Mastercard network, it's accepted anywhere in the world Plus, you have access to Mastercard benefits, like identity theft protection and discounts worldwide And because Apple Card is designed to have no fees 4 at all, you won't get charged any foreign transaction fees

Buy Mattel Apples To Apples Junior The Game Of Crazy Comparisons Online At Low Prices In India Amazon In

Apple Card Sign Up Page Is Now Live Here S How To Apply Trusted Reviews

· Using the Apple card, it is easy to make digital Apple payments as well as a physical card It is made of titanium, and it includes laser etched with the owner's name The Apple new credit card is from Goldman Sachs, and it works with Apple Pay and iPhone's Wallet app · Apple Card boasts zero fees, lower interest rates and flexible repayments Users can also manage their spending through the Wallet app, and rewards them with a new loyalty scheme called Daily Cash · In the US, interchange fees are relatively high They typically start at around 08% of the transaction plus 15c, and rise as high as 295% plus

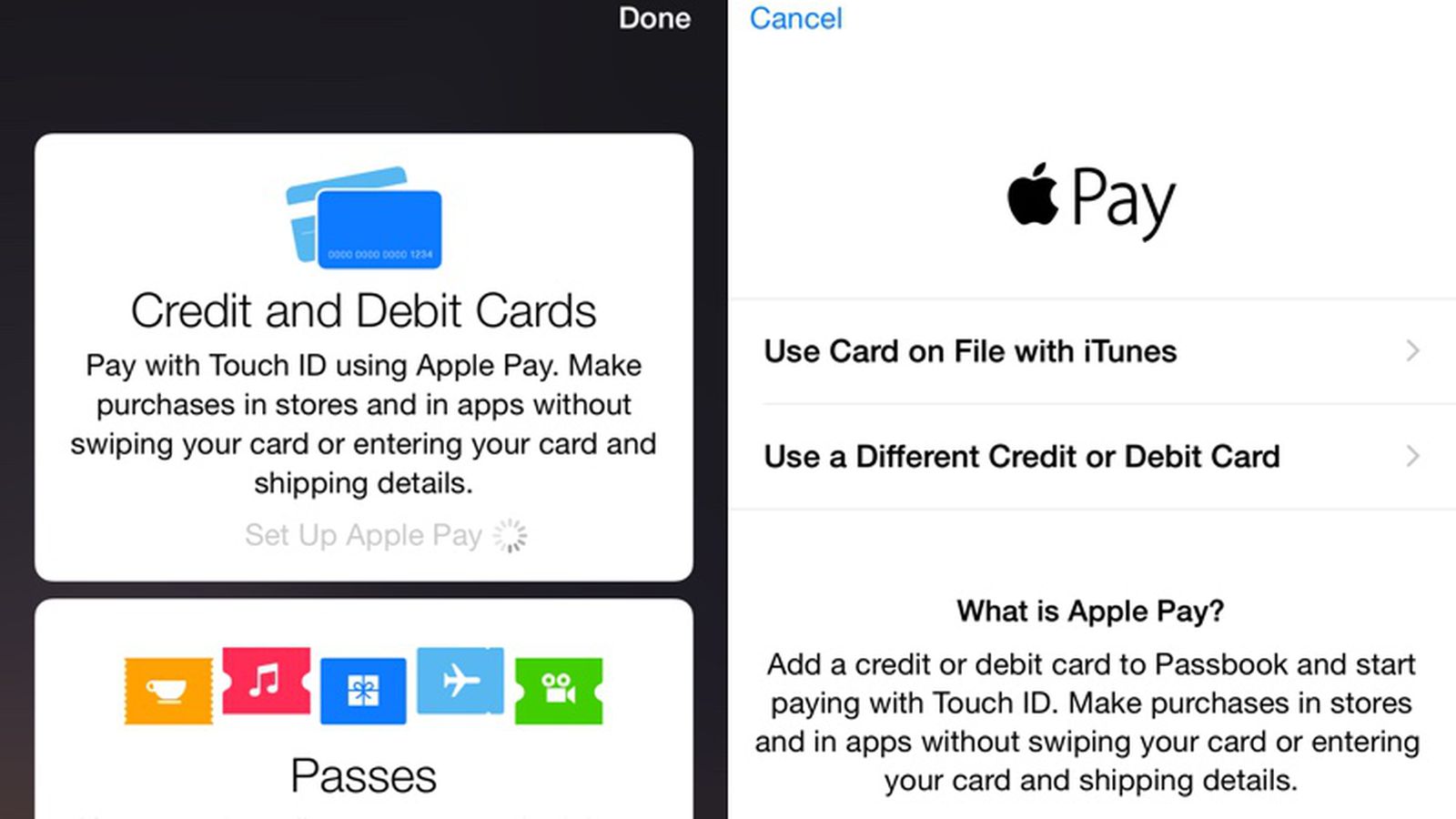

How To Set Up Apple Pay And Add Credit Cards Macrumors

Apple Card Officially Launches In The U S Venturebeat

Sign in to view your Apple Card balances, Apple Card Monthly Installments, make payments, and download your monthly statements · Apple Card Family lets you add up to four other people to your Apple Card credit account Two people will be named coowners of the Apple Card, but everyone can make purchases with it Everyone in

How To Apply For Apple Card And Use It On Your Iphone Cnet

How To Add Unsupported Cards Passes To Apple Wallet For Quick Easy Access On Your Iphone Ios Iphone Gadget Hacks

Apples To Apples Junior Game Review Famlygameshelf Com

Apples To Apples Blank Cards For Laser Printer Board Game

Dirty Apple To Apples Cards Against Humanity Cardsagainsthumanity

Apples To Apples Party Game Review Geeky Hobbies

Apple Card Sign Up Page Is Now Live Here S How To Apply Trusted Reviews

Rule Guide For The Apples To Apples Card Game

How To Play Disney Apples To Apples Official Rules Ultraboardgames

Apple Stamped Love You To The Core Teacher Appreciation Cards

Set Up Apple Pay Apple Support

How To Use Apple Gift Card On Iphone Ipad Mac 9to5mac

Apples To Apples To Words 10 Minute Novelists

Apples To Apples Junior Mattel Games

Apples To Apples Party Box New Ebay

Manage The Cards That You Use With Apple Pay Apple Support

How To Make Purchases With Apple Card Apple Support

Rule Guide For The Apples To Apples Card Game

Survey Shows Apple Card Awareness Is Remarkably High Boding Well For Its Success Imore

Apples To Apples To Words Weekly Writing Challenge 10 Minute Novelists

Apples To Appels Appel Farm Arts Camp

How To Play Apples To Apples Official Rules Ultraboardgames

Game Activity Manzanas Con Manzanas Apples To Apples By Kelsi Churchill

How To Make A Thank You Teacher Apple Card

Rule Guide For The Apples To Apples Card Game

Everything You Need To Know About How To Apply For And Use The Apple Card Appleinsider

Big Picture Apples To Apples Board Game Review And Rules Geeky Hobbies

Apple Introduces Apple Card Family Enabling People To Share Apple Card And Build Credit Together Apple

:max_bytes(150000):strip_icc()/how-to-add-apple-gift-card-to-wallet-card02-cb81de887f8c48e4938b6781cb171ea1.jpg)

How To Add Apple Gift Cards To Wallet

Love You To The Core Card Apple Card Love Card Anniversary Etsy

Apples To Apples To Words Weekly Writing Challenge 10 Minute Novelists

Combining Cards Against Humanity With Apples To Apples Produced Results Better Than Expected Funny

Apple Sensory Cards

Apples To Apples Big Picture Giveaway

How To Play Apples To Apples Official Rules Ultraboardgames

/pic165971.jpg)

Boardgamegeek

Played Sour Apples To Apples 52 366

Apple Cards Have Started To Appear On Some Experian Credit Reports Imore

Apples To Apples Mattel Games

Apple To Apples Kids 7 Plus The Game Of Crazy Comparisons Amazon Co Uk Toys Games

Mattel Apples To Apples Review

Fun Wedding Reception Activities Wedding Reception Games Reception Activities Wedding Reception Fun

Apples To Apples Party Game Review Geeky Hobbies

Board Game Apples To Apples Becomes A Videogame Destructoid

Buy Apple Gift Cards Apple

How To Play Apples To Apples Youtube

Introducing Apple Card A New Kind Of Credit Card Created By Apple Apple

How To Get Approved For Apple Card After Being Declined 9to5mac

Variations For Apples To Apples Ultraboardgames

Apple Card Release Date And All We Know About The New Iphone Centric Credit Card Techradar

Apples To Apples Party Box Amazon Co Uk Toys Games

Apples To Apples Rules

Apples To Apples Junior Game Review Printable Game Sheet

:max_bytes(150000):strip_icc()/how-to-add-apple-gift-card-to-wallet-addfunds01-4ac5b3ae5a9745cdb5ffdb76b274c92a.jpg)

How To Add Apple Gift Cards To Wallet

Rule Guide For The Apples To Apples Card Game

Request And Activate A Titanium Apple Card Apple Support

Adapting Games Apples To Apples Teachinggamesefl Com By Mike Astbury

Apples To Apples Wikipedia

Thingstodo

How To Recycle Apple Cards A Greener Way To Cut The Credit Line Techrepublic

Macworld

Apples To Apples Junior Game Review Printable Game Sheet

Apples To Apples Rules

How To Use Itunes Gift Cards To Pay For Apple Music

Apples To Apples Rules

About Me Apple Card For Meet The Teacher Day Video The Soccer Mom Blog

How To Add An Apple Card To Ipad Apple Watch Or Mac

Apple Card Now Available To All Us Iphone Users Tidbits

Apples To Apples 504 Braille Cards Red Box

Apples To Apples Party Game Review Geeky Hobbies

Apples To Apples Junior Game Review Famlygameshelf Com

Apples To Apples Or Cards Against Humanity Album On Imgur

Apples To Apples To Words Writing Challenge 10 Minute Novelists

Game Day Apples To Apples

0 件のコメント:

コメントを投稿